The cloud is making inroads into the enterprise, but on-premises IT infrastructure remains a critical part of companies' IT strategies. According to the Interop ITX and InformationWeek 2018 State of Infrastructure study, companies are continuing to invest in data center, storage, and networking infrastructure as they build out their digital strategies.

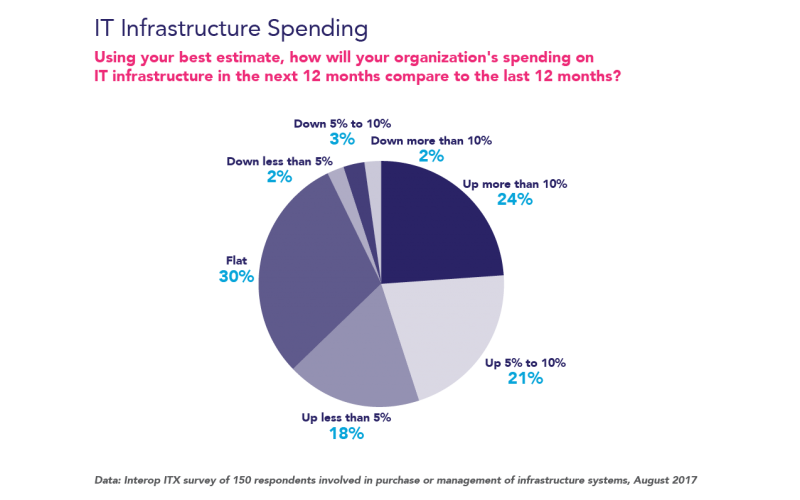

The survey, which polled 150 IT leaders and practitioners from a range of industries and company sizes, found that 24% said their organization plans to increase spending on IT infrastructure by more than 10% in the next year. Twenty-one percent plan to spend 5% to 10% more on IT infrastructure spending compared to last year while 18% expect to spend no more than 5%.

Twenty-seven percent of IT leaders surveyed said their organizations plan to increase build out or support of IT infrastructure in order to support new business opportunities. Another 30% cited increased workforce demands as the driver for a bigger focus on infrastructure.

Enterprises are investing in a variety of technologies to help them achieve their digital goals and keep up with changing demands, according to the study. Storage is a huge focus for companies as they try to keep pace with skyrocketing data growth. In fact, the rapid growth of data and data storage is the single greatest factor driving change in IT infrastructure, the survey showed.

Companies are also focused on boosting network security, increasing bandwidth, adding more servers to their data centers, and building out their WLANs.

At the same time, they see plenty of challenges ahead to modernizing their infrastructure, including cost of implementation, lack of staff expertise, and security concerns.

Read ahead to find out what organizations are planning in the year ahead for their IT infrastructure. For the full survey results, download the complete report. Learn more about infrastructure trends at Interop ITX in Las Vegas April 30-May 4. Register today!

(Image: Connect world/Shutterstock)