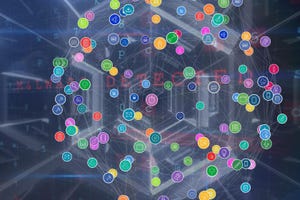

Data center network for AI

Network Infrastructure

Network Support for AINetwork Support for AI

Is your network ready to handle AI processing and data? Here are some points to consider.

SUBSCRIBE TO OUR NEWSLETTER

Stay informed! Sign up to get expert advice and insight delivered direct to your inbox