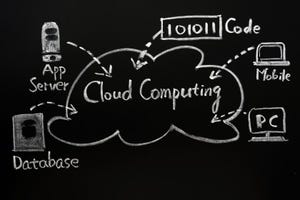

Cloud Networking

Cloud networking is the use of cloud computing technologies and services to optimize and manage network infrastructure and resources.

Complexity cycle

Network Infrastructure

The Complexity Cycle: Infrastructure Sprawl is a KillerThe Complexity Cycle: Infrastructure Sprawl is a Killer

Standardizing with a platform approach is the way to put the brakes on the complexity cycle. You can’t stop the cycle completely. But you can slow it down so it doesn’t overwhelm you.

SUBSCRIBE TO OUR NEWSLETTER

Stay informed! Sign up to get expert advice and insight delivered direct to your inbox