With SDN deployments growing beyond pilot projects this year, the market for software-defined networking will nearly double from last year, according to a new report from IHS.

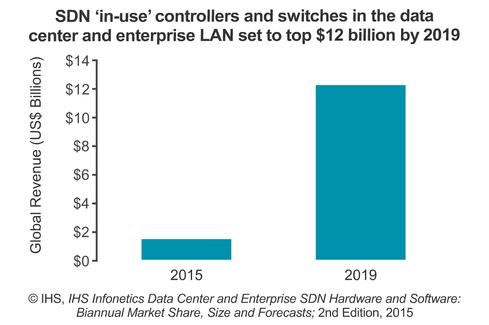

IHS forecasts the market for "in-use" SDN Ethernet switches and controllers used in the data center and enterprise LAN to top $1.4 billion this year. By 2019, it estimates that the market will top $12 billion.

By "in-use," IHS means SDN-capable switches that are actually used by enterprise customers for SDN, Cliff Grossner, Ph.D., research director of data center, cloud and SDN at IHS, told me in an interview. Vendors can ship Ethernet switches as SDN capable by adding a programmable interface, but it doesn't mean that customers are using them for SDN.

What's driving the growth in SDN deployments is the fact that enterprises and data center operators have had time to take SDN into the lab and understand how to deploy it on a small scale, he said. They're now ready to take those small deployments and expand them.

"For the rest of 2015 and into 2016, it will be customers who have already deployed SDN scaling up as much as new customers deploying SDN," Grossner said. "There's enough of a critical mass of customers who have deployed islands of SDN and are ready to scale."

He also expects more SDN growth outside the data center in the enterprise LAN.

A big element that’s helping drive SDN growth, especially in the data center, is demand for bare-metal switches, he said. Bare-metal switches accounted for 45% of global in-use SDN-capable Ethernet switch revenue in the first half of 2015, according to IHS.

IT managers are interested in having a choice of network operating system for their switch not so much for reduced capex, but rather to have the ability to manage switches with the same platform that they manage servers, Grossner said.

The increasing available of branded bare-metal switches from vendors like Dell and Hewlett-Packard Enterprise is reducing integration requirements and helping boost IHS' forecast for SDN growth, he said.

According to IHS, Dell owned 100% of branded bare-metal switch revenue in the first half of 2015. Grossner said Dell was the only vendor shipping bare-metal switches in the first half of this year; HPE began shipping in the second half.

The IHS report showed that SDN in-use physical Ethernet switches will comprise 15% of the overall Ethernet switch market revenue in 2017, up from 4% today.

Grossner said the SDN market has overcome technical challenges, but still faces cultural and human challenges.

"So many successful SDN deployments have had to overcome organizational and structural challenges by having separate networking, storage and compute teams and bringing those together under one roof," he said.