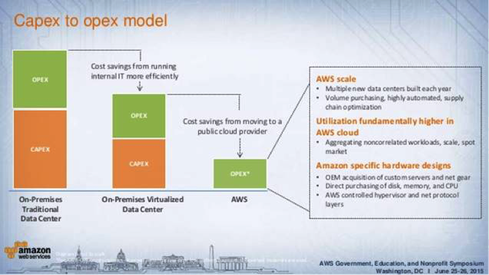

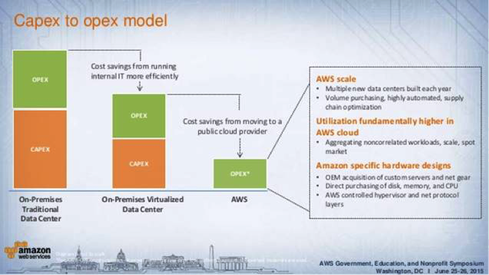

Hyperscale cloud service providers are driving a change from hardware-defined data center infrastructure to software-defined infrastructure. This new architecture is bringing with it a dramatic transition in how infrastructure is purchased. IT organizations are shifting to on-premise or off-premise managed private clouds, and to public cloud infrastructure that transforms their spending from a capex to opex model.

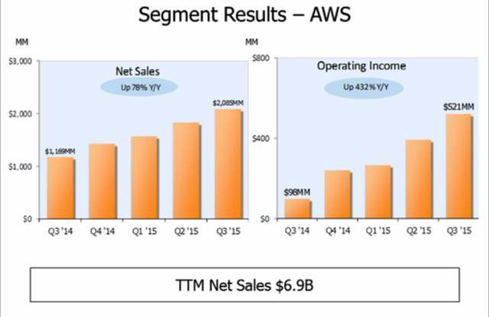

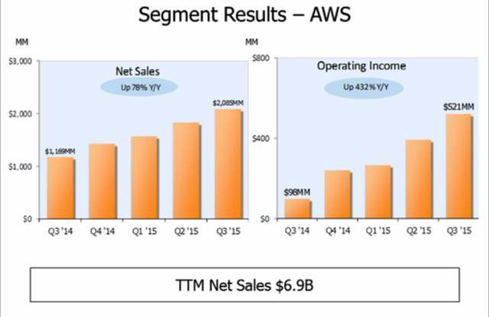

Amazon recently announced its third quarter earnings results, and the numbers provide hard data on how much IT organizations are spending on opex. The data also reveals what the future of opex may look like.

The UC Berkeley RAD Lab estimated that cloud providers have data center costs that are up to 80% lower than the enterprise. Some of this is due to purchasing power, some is through more efficient management practices, and some because these businesses are managed with a laser focus on cost. Add to that the fact that in a traditional data center environment, when servers, networks or storage are running at 20% utilization, the effective cost of that capital equipment is actually five times higher. With managed private or public cloud computing, you pay for only what you use.

AWS reported revenues of $2.1 billion for Q3, which means the company is on track to rack up sales of $8 billion for the full year. IT Brand Pulse estimates that storage comprises 15% of those sales, or $1.2 billion for the year.

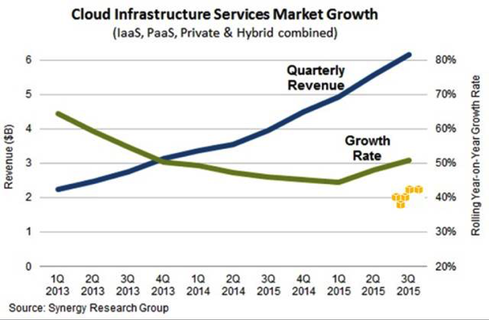

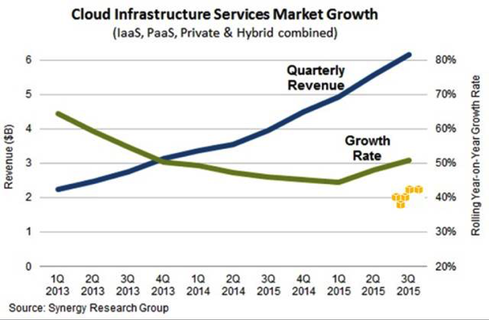

Synergy Research Group estimated IT organizations spent a little over $6 billion in the third quarter of 2015. Given that AWS reported revenues of $2.1 billion, that translates to AWS owning about one-third of the market for IT opex for data center infrastructure.

When we analyze the AWS results along with Synergy Research Group's data, we can estimate that the overall 2015 market for data center infrastructure opex is $23.7 billion. The portion of that relating to storage infrastructure opex is then $3.56 billion.

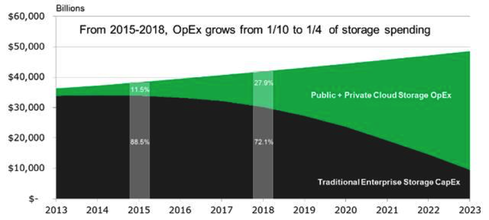

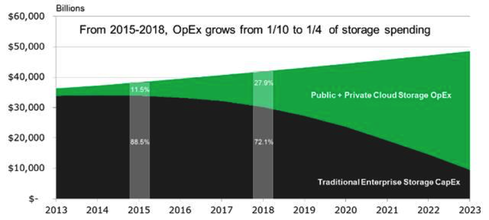

To make projections about where storage opex spending is heading based on the AWS and Synergy data, we built the model below. As you can see, the model shows that on-premise and off-premise private clouds will take off and outpace the growth of public cloud storage.

If you graph the data above, it reveals the market for public and private cloud opex storage will grow from 11% of the storage market in 2015, to 28% of the market in 2018, and 80% of all storage in 2023.

The epic migration to an opex-driven data center infrastructure is well on its way. Expect this trend to accelerate in the next few years, as private cloud offerings make it easier for IT organizations to make the leap.